HBAR has remained in a prolonged period of consolidation, with limited growth over the last two months. Its repeated attempts to break out of the $0.40 resistance level have failed, dampening trader sentiment.

This lack of upward momentum has led to growing skepticism in the market regarding the token’s short-term performance.

HBAR Traders Change Their Opinion

HBAR’s funding rate recently dipped into the bearish zone after maintaining positive levels for over 11 days. This shift indicates that traders have turned bearish as short contracts gained dominance over long positions. The failed breakout attempts have caused traders to reevaluate their outlook, leading to a cautious stance on HBAR.

The increasing preference for short contracts suggests growing uncertainty among market participants. This stems from skepticism about HBAR’s ability to overcome resistance levels, reinforcing the need for the token to secure stronger support to regain investor confidence.

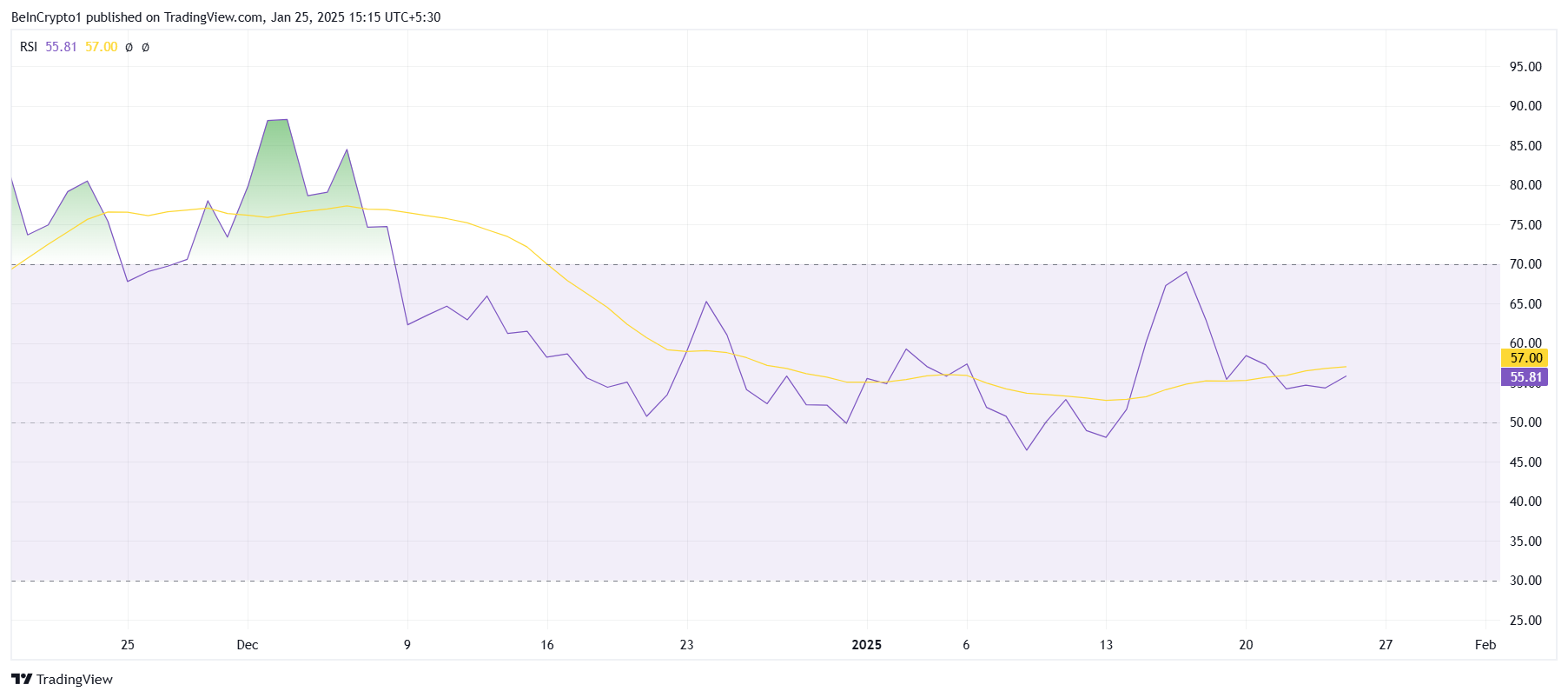

Despite the bearish sentiment, HBAR’s Relative Strength Index (RSI) remains above the neutral 50.0 mark. This indicates that the broader market momentum is still favoring bullish trends, providing a potential buffer against bearish pressure. The RSI’s position highlights that HBAR retains some underlying strength.

The RSI’s stability could prevent HBAR from experiencing sharp declines, even as bearish cues dominate short-term market sentiment. If the broader cryptocurrency market continues to hold bullish momentum, HBAR may find support and avoid further consolidation at lower levels.

HBAR Price Prediction: Breaking Out

HBAR is currently trading at $0.33, aiming to establish this level as a support floor. Successfully doing so is critical for the token to challenge the $0.39 resistance level. A break above this resistance could set the stage for further upward movement.

The mixed market sentiments could play a pivotal role in determining HBAR’s direction. If the token manages to rise beyond $0.39, it could rally toward $0.47, bringing it closer to its all-time high of $0.57. This scenario would require sustained bullish momentum and renewed market confidence.

However, a decline to $0.25 would likely result in continued consolidation for HBAR. Any further drop below this level would invalidate the bullish outlook entirely, signaling potential long-term weakness.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment